Personalise your payday

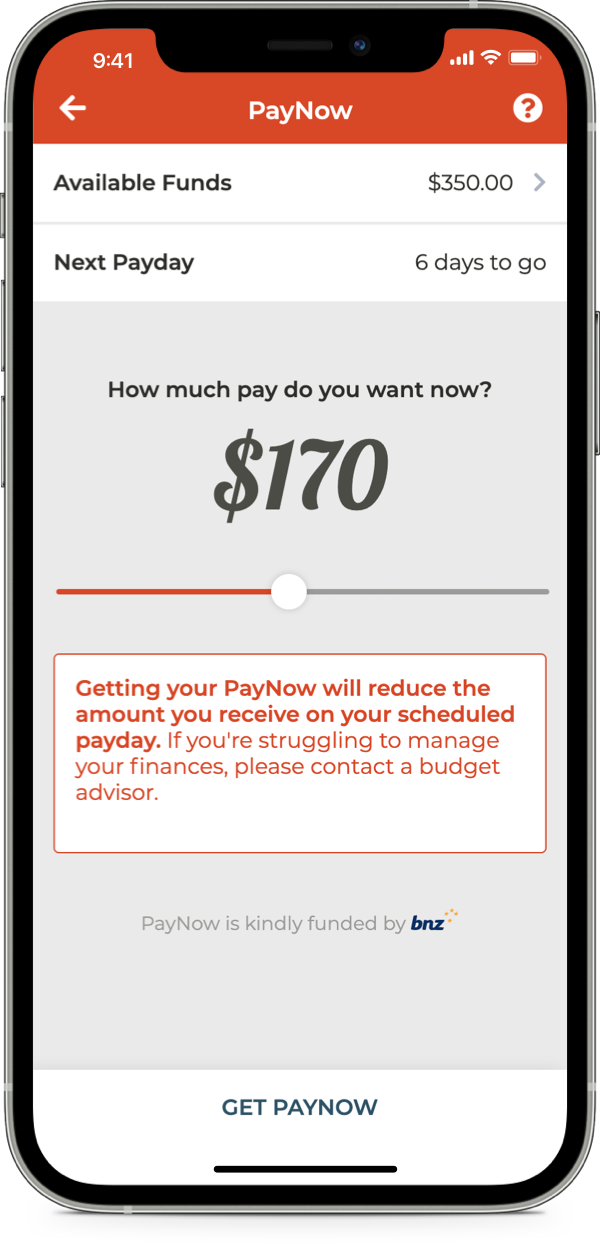

PayNow is a unique feature in the PaySauce mobile app that lets employees access the money they’ve already earned, effectively letting you choose your own payday on demand.

Your earnings, anytime

So you’ve done some work, but haven’t been paid yet. You’ve already earned a chunk of cash for the hours you’ve worked since your last payday - so we make that money available to you, on your time. PayNow just helps you collect your own money when you need it.

You can access your available earnings using the PaySauce app - it’ll only show you the amount that you’ve earned since your last payday. Choose an amount to request, and you get paid - usually within an hour!

When payday comes around, your employer processes payroll as usual, less the amount you have already received; the rest comes to you.

Handle unexpected expenses

Cars break down, teeth get sore, and stuff happens. If you're on fortnightly or monthly pays, payday can be a long wait. PayNow gives you access to your own earnings to provide a solution to these nasty surprises.

So long, loan sharks

Kiwis who are short on cash often resort to high-cost, predatory lenders. PayNow gives you a better option. It is not a loan, so there are no borrowing fees or interest, and there’s no danger of creating more debt.

PayNow is part of BNZ’s mission to disrupt predatory lending in New Zealand which includes support for programmes such as Good Loans and Habitat for Humanity Home Repair programme. Through these partnerships BNZ has provided more than $12 million in low & no interest lending to support those who need it most.

FAQs

You need to be a PaySauce payroll customer. If you aren't a PaySauce customer, you can sign up here. PayNow is available no matter which bank you're with.

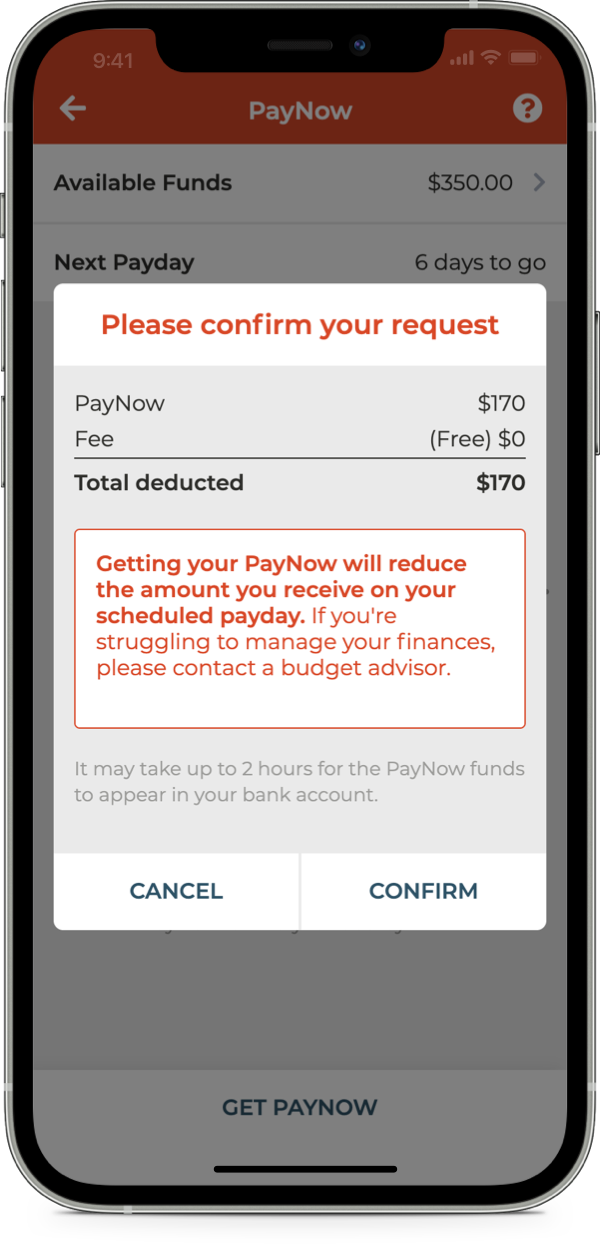

It’s all funded by BNZ. No fees and no interest, period. There’s no cash flow impact to the employer at all, and no hidden costs to the employee.

Your employer just has to be subscribed to PaySauce Payroll - then you can use the mobile app to access PayNow.

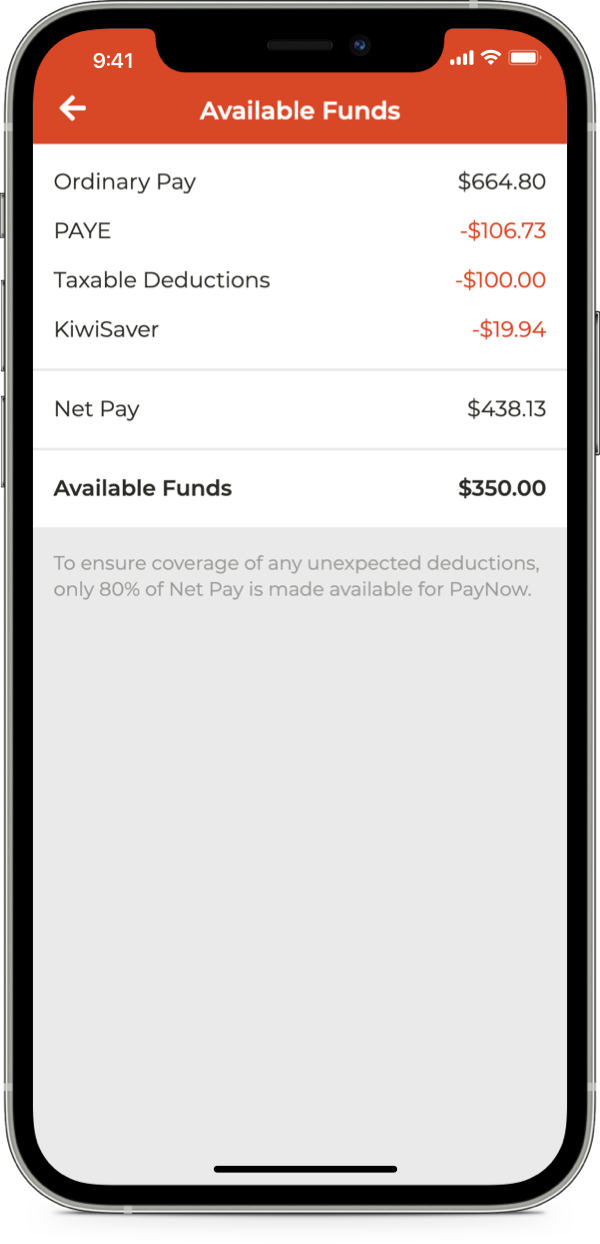

You can get up to 80% of the amount earned since your last pay, minus any deductions like PAYE, KiwiSaver, child support etc.

So, for example, let’s say you’re on a fortnightly pay, working 5 days/week and you earn $1,500 each pay after taxes and deductions. After 4 working days, you’d have access to a maximum of $480 of wages.

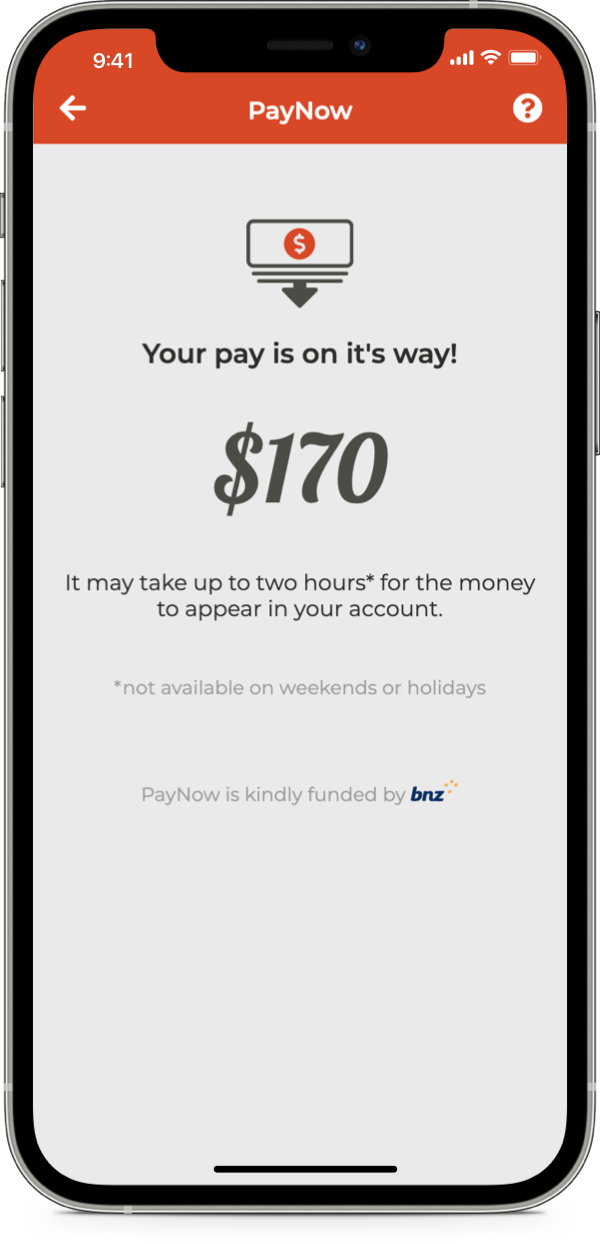

Once your request is submitted, it can take anywhere from a few minutes to a few hours. In some cases it might be processed overnight and you’ll see the payment the next day.

Afraid not. We can only process PayNow on a normal business day. Requests are allowed Monday – Friday between 6am and 9pm.

It’s free!

A BNZ fund earmarked just for running PayNow. Any on-demand payments will then be paid back by your employer on your standard payday.

As much as you like, but you can only have one open pending payment at any time and you need to have already earned enough funds. You can only make one PayNow request per day.

Nope, no interest - it’s not a loan, it’s your dosh!

No, PayNow doesn’t impact the employer at all. It is free for the employer to provide the feature in the PaySauce app and there are no charges when employees use it.

Employees need to go through an identity verification process and answer three questions about how they use PayNow. We’re required by law to collect this information from everyone who wants to use PayNow to fulfil our anti-money laundering and countering financing of terrorism (AML/CFT) obligations.

AML/CFT stands for anti-money laundering and countering financing of terrorism.

PaySauce are required by law to collect information from everyone who wants to use the PayNow service via identity verification and by asking a few questions about how they will use PayNow.

You need to have a NZ Drivers license or NZ Passport to complete the verification process to use PayNow.

Yes, you need to be 18 years or older to use this feature.

PayNow is part of BNZ's commitment to manaakitanga, or caring for people and communities. It is offered alongside other key partnerships, Good Loans, Habitat for Humanity and Money Sweetspot. Through these programmes, BNZ has enabled more than $40 million in no or low interest loans and advances to help improve the lives of New Zealanders.