PaySimple

Powerful payroll essentials

PaySimple is no longer available. Please check our pricing page for available plans.

PaySimple is a streamlined version of PaySauce for small businesses wanting an affordable cloud payroll solution.

PaySimple quickly and accurates calculates pays, IRD payments, and leave transactions.

PaySauce offers PaySimple in partnership with accounting and bookkeeping firms throughout New Zealand.

If you’re an accountant or bookkeeper and want to offer PaySimple to your clients, drop us a line at [email protected] or click here.

We’ll support you in quickly and smoothly shifting clients onto PaySimple from other desktop or cloud-based payroll systems.

If you’re a business owner interested in using PaySimple, get in touch with one of our partner practices or talk to your adviser about connecting with PaySimple.

Simple Sauce

PaySimple is a streamlined version of PaySauce payroll software, supported by our trusted accounting partners.

All the essentials

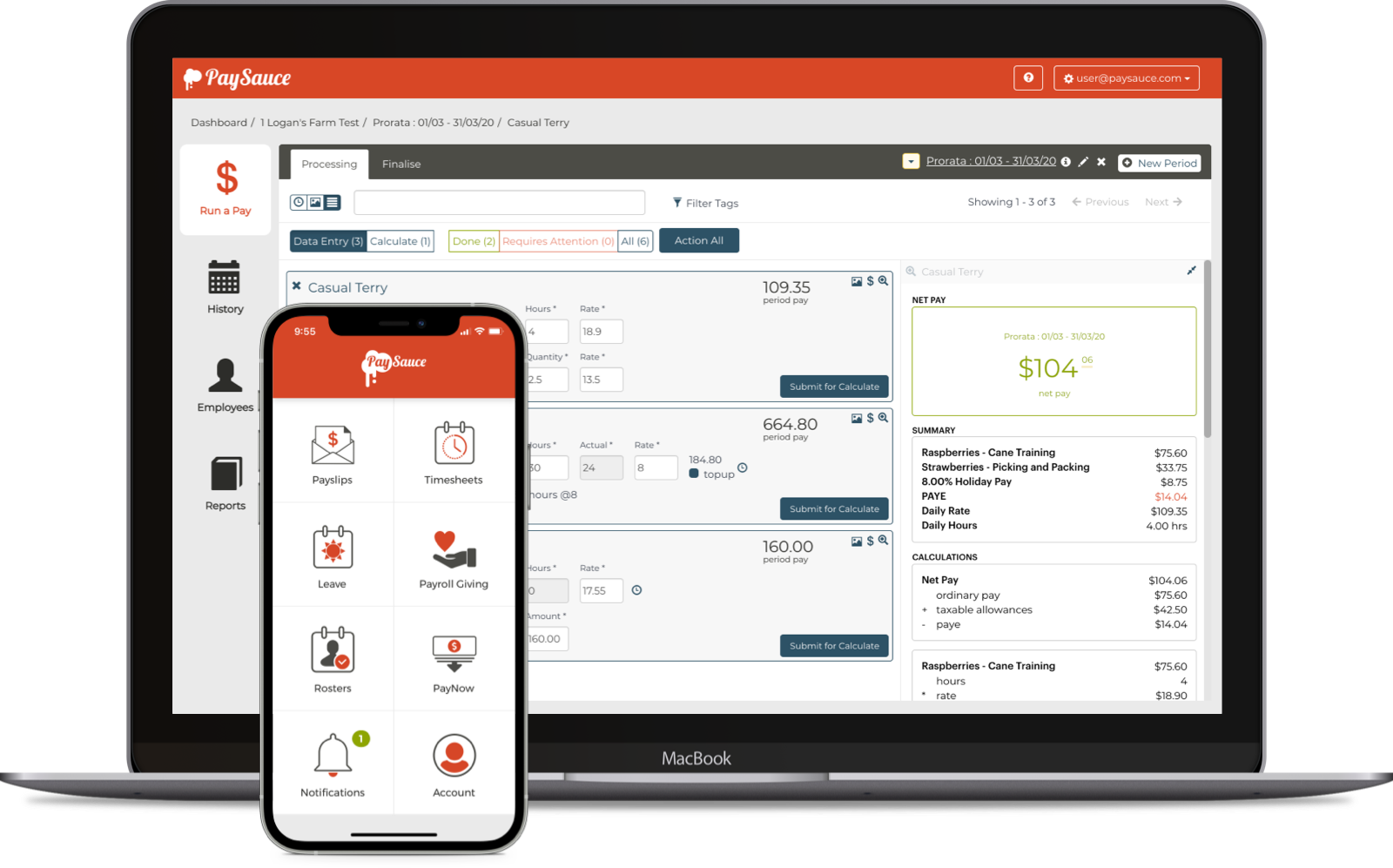

PaySimple handles all your calculations, payslips and reporting, while you handle payments and IR filing. Take care of all your people, whether they’re salaried, hourly, casuals, or contractors.

Contactless cloud payroll

Run compliance-proof pays from wherever you are. Keep all your records secure and reachable from any device or location.

Keep the whole team mobile

Stay connected to your team, no matter where they’re at. Staff can view payslips and leave info whenever, wherever, with our apps for iPhone and Android.

But wait, there’s more!

PaySimple also includes a range of extra PaySauce features like Minimum Wage Top-Up for salaried staff in seasonal industries, Payroll Giving, and flexible paydays with Pay Advance.

The following firms have partnered with us to offer PaySimple to Kiwi businesses

General FAQ

What’s the difference between PaySimple and PaySauce?

PaySimple doesn’t include access to PaySauce in-house phone or email support, costings or timesheets, and doesn’t automate payments to staff. PaySimple clients will also need to manage their own IR filing. All PaySauce How To resources are still available for free.

| PaySimple | PaySauce | |

|---|---|---|

| Pay calculations for any type of employee including salaried, fixed term, casual, varied hours staff and contractors | ||

| KiwiSaver employer contributions and employee deduction calculations | ||

| The ability to download banking files and upload to your bank for ease of payments | ||

| The ability to download Payday Filing reports for upload to Inland Revenue | ||

| Records and calculations for staff leave transactions | ||

| Xero Integration | ||

| Minimum Wage Top-Ups | ||

| Mobile app for employees (including payslips & leave management) | ||

| Reporting | ||

| Free Setup | ||

| Phone or email support | ||

| Custom Costings | ||

| Timesheets | ||

| Automated Banking | ||

| Automated Filing |

How does customer support work with PaySimple?

Employers will need to contact their accountant with any support questions. They’re well-equipped to answer any questions, and they have direct access to our dedicated partner support team, so they’ll be able to handle your concerns.

What's the catch?

With PaySimple, employers and accountants will need to do a little bit of the heavy lifting. Payday filing and bank payment files will have to be uploaded to myIR and the employer’s bank each payday.

How do I upgrade to PaySauce?

If an employer wants to jump onto one of our subscription plans to get our full feature set, they can ask their accountant about changing over to PaySauce.

Technical FAQ

How can a business sign up to use PaySimple?

PaySimple is managed by our PaySauce Partners. A guide for our accounting partners to sign up their clients is available here.

How does Payday Filing work in PaySimple?

PaySimple generates employment information in the correct format for upload. Employers or their financial advisors must then load this into myIR within 2 business days of payday.

How does running a pay work in PaySimple?

A full guide to running a pay in PaySauce is available here. Follow the same steps to run a pay in PaySimple, but note that payments and IRD filing will have to be done manually through the bank and myIR respectively.

Can PaySimple generate bank payment files?

Bank payment files from ANZ, ASB, BNZ, and Westpac can be downloaded from the RUN A PAY area of PaySimple and then uploaded to a bank. Links to guides from those banks are included below.

ANZ ASB BNZ WestpacImportant Note: Bank payment files can only be downloaded before a pay is closed. They cannot be downloaded from the HISTORY area.