SmartPayroll

Product Comparison

It’s common to see businesses talking rubbish about their competition. We’re not fans of that approach.

In our product comparison series, we’ll give you an unvarnished look at the good, the bad, and the ugly when it comes to other payroll software providers.

SmartPayroll

SmartPayroll is one of the best payroll software options available in New Zealand. Like PaySauce, SmartPayroll offers data capture tools, full calculation and PAYE intermediary services, and a cost-effective pricing structure.

SmartPayroll is made by Datacom, New Zealand’s giant IT service provider and developer. It’s one of a number of brands that Datacom runs on the same software, including NetPay and Edge Payroll.

Here’s how PaySauce is different...

First, a quick history lesson

Our CEO and co-founder, Asantha Wijeyeratne, is the guy who started SmartPayroll. He licensed the software from Datacom, who owned a part of the company.

When SmartPayroll came out the gate it was cutting-edge stuff. The first PAYE Intermediary software in New Zealand (which takes care of all your banking and PAYE filing).

Asantha built the business to nearly 10,000 customers, with a foundation focused on customer service. SmartPayroll’s customers raved about the support they got on the phone.

But Asantha wasn’t happy. He knew that customer service wasn’t enough, and the product had to keep improving. Because Datacom still owned the SmartPayroll software, they decided what to do with it. That’s an important reason he left the business in 2011.

Three years later, he started PaySauce (under the name Simply Payroll). Our mission here is to develop world-class, modern payroll software you can run from anywhere, and back it up with committed support. We nabbed some of the best staff from SmartPayroll and got the ball rolling in 2015.

Payroll on the run

We believe the future of small business computing is mobile. If your payroll system doesn’t have mobile app functionality, you’re probably missing an opportunity to save mega time on data capture and to provide your employees with key info on demand.

SmartPayroll has two apps available for iOS and Android: one for employees, and one for employers. If you look in the App Store, you’ll see the same separation for NetPay and Edge Payroll, because it’s the same software. Employees can view payslips and leave balances, and enter timesheets. Employers can view their next pay date, and approve a payrun that has already been processed on the Smart Payroll website.

PaySauce has just the one app in the app store (and what you see is determined by whether you’re an employee or an employer). Simple. The app also goes a bit further. Staff can make leave requests that are sent to their manager for approval (important to keep those leave requests in one place). Customers can also run a full pay from their mobile app, wherever they are on payday. If you’re out of the office and on the run, or heading away on holiday, this is an important feature.

Because we are so much younger, we have a technology advantage that lets us develop more quickly than our competition (even when battling giants like Datacom). What you’ll notice is that our app looks like you’d expect from modern software, which believe it or not is important when it comes to getting staff to use it.

As far as we know, PaySauce is also the only mobile payroll application in the world that lets you process a full pay from your mobile phone, including timesheet capture, calculations, banking, and tax filing with Inland Revenue (or the equivalent).

We’ve also added a number of features to make payroll even easier:

Employee Self Service

Because new staff can enter their own details straight into the app, PaySauce helps cut down paperwork and employee set up is faster than SmartPayroll.

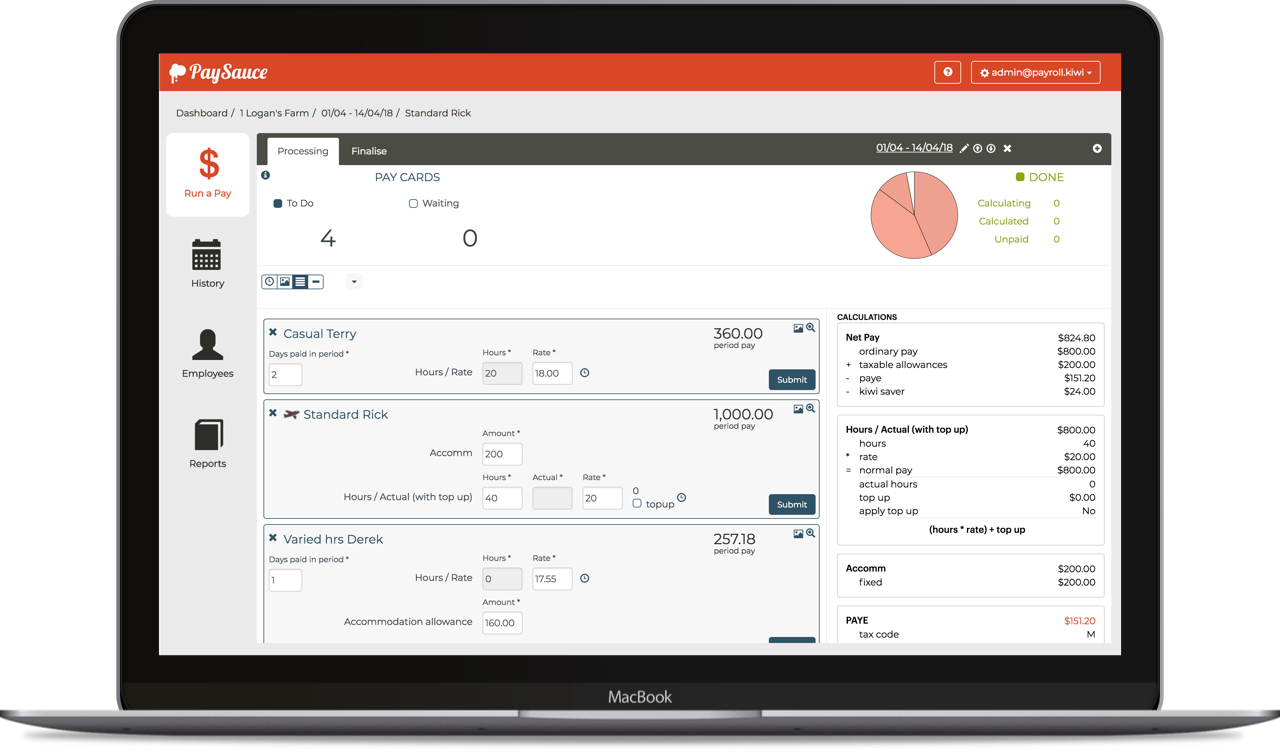

Transparent Calculations

With one click, PaySauce shows calculations for every element of an employee’s payslip. This keeps payroll transparent and can help if a dispute ever arises.

With SmartPayroll, it’s difficult to establish exactly how a calculation is made (particularly with things like minimum wage top-ups).

Quick Reports

At paytime, PaySauce provides quick reports on screen for a last minute check before closing a pay off. With SmartPayroll, you need to download reports for checking before closing a pay. This isn’t a big deal, but it’s just another little timesaver (particularly if you’re running pays for multiple companies).

PaySauce also displays the ‘Detail’ screen which records all settings changes made in that pay period. This allows efficient confirmation that all scheduled changes - e.g. KiwiSaver alterations, tax code updates - were made as planned.

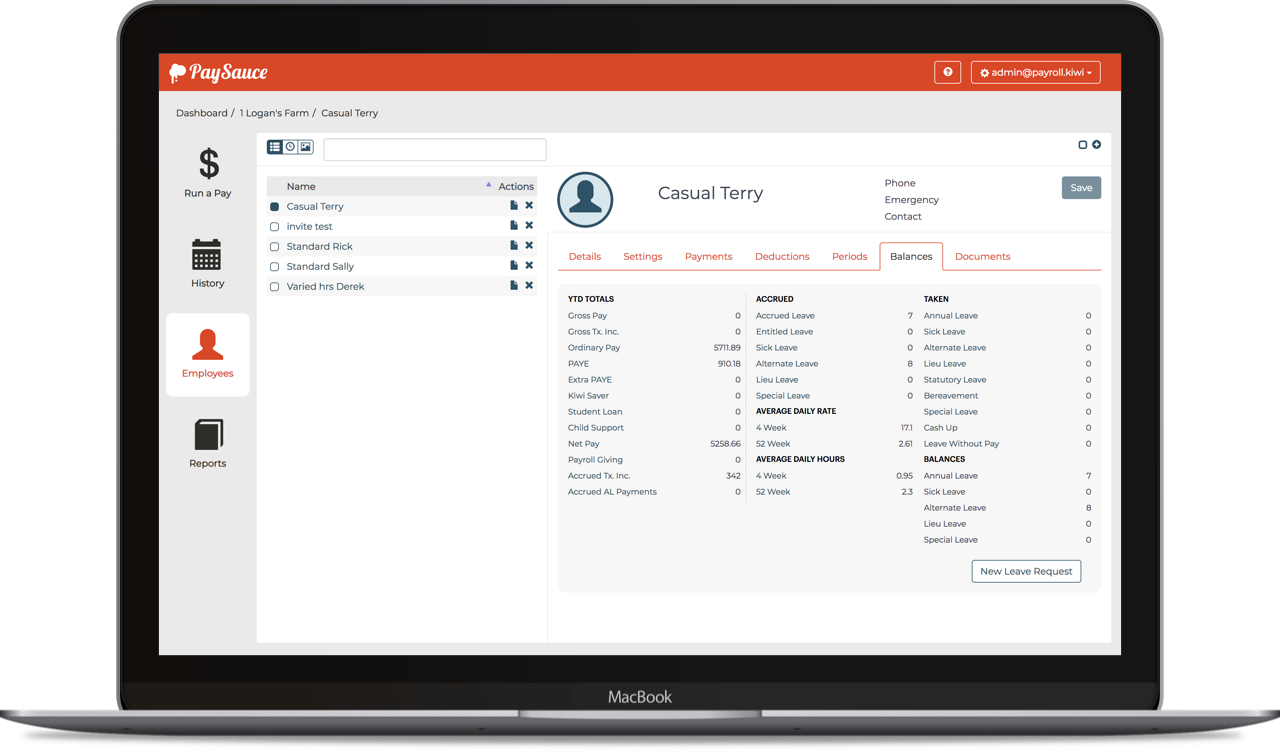

Leave Details at a Glance

The Balances screen in PaySauce helps you track down important info quickly. It includes a history of payments made, leave taken, any adjustments completed, and a calculation of average daily payments and average hours worked per day for both 4-week and 52-week periods.

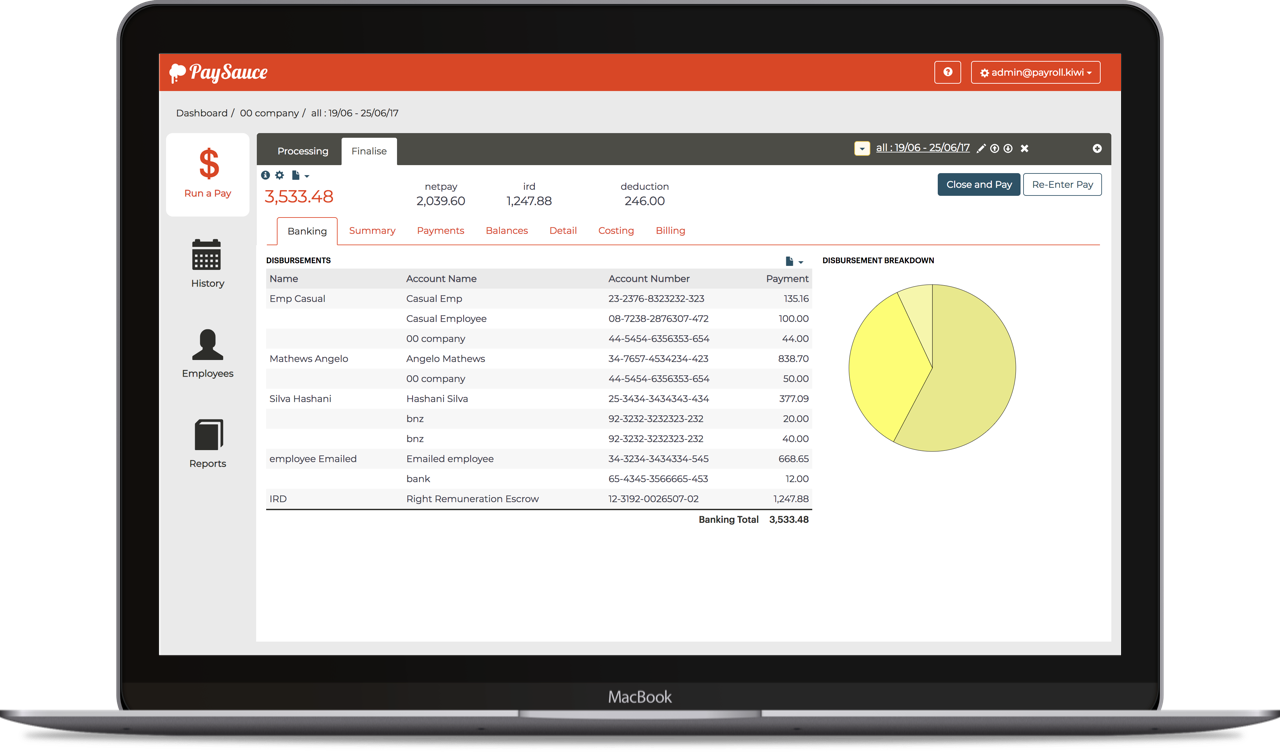

Payday Filing

With Inland Revenue’s Payday Filing scheme kicking off on 1 April 2019, many businesses will be required to file PAYE within two business days of payday rather than on the 20th of the following month.

That’s when you’ll be wanting to use a full PAYE intermediary solution like SmartPayroll or PaySauce, which will take care of all your banking via direct debit, and PAYE filing via direct integration with Inland Revenue. Think of the intermediary service as a one-stop shop.

We’ve already completed the Inland Revenue integration nice and early (the first payroll intermediary in NZ to get it done). But we’re confident Datacom will have their products ready by go-live date.

Read more about payday filing here.

Agricultural customers

This is our area of expertise. PaySauce allows tracking of timesheets for salaried staff, tops up to minimum wage to keep the labour inspectors happy, and integrates with agri-specific products like Cashmanager RURAL and Cash Manager Focus. We partner with Federated Farmers and understand the industry.

Plus, because we look after over 600 agri customers (mostly dairy with some sheep & beef and croppers), when you call our support desk they know all the whacky stuff that happens with farm payroll.

SmartPayroll has been making efforts in the agricultural area over the last year. We’ve had reports from customers that there are challenges on dairy farms due to SmartPayroll not coping with rolling rosters (where staff might work all seven days in a week e.g. on an 11/3) and suggesting top-ups where none are needed. Something to take a look at.

Pricing

SmartPayroll is priced reasonably. $50 set up fee, then $20 per month and a per payslip fee that varies depending on number of employees.

PaySauce is priced very similarly, except we don’t charge a set-up fee. If you’re paying fortnightly or monthly, we are likely to be cheaper because of the way we charge. If you’re paying weekly, we may be slightly more expensive in the long run.

Update - 25 March 2019:SmartPayroll have recently increased their pricing. Their per payslip fee is now fixed at 1.99 per employee. They also still include a $50 setup fee and $20 monthly fee.

With no setup or monthly fees, PaySauce is less expensive regardless how you slice it.

You can find our pricing calculator here.

Support

SmartPayroll has great support. We should know - Vicky Taylor, our head of support, ran the team at SmartPayroll for many years! We’ve brought that same customer-focused philosophy over to PaySauce (along with two more of their excellent helpdesk team).

When you’re looking for a payroll provider, you want to be sure you can get reliable access to help over the phone. Paying staff is urgent and important, and email support isn’t enough.

The Verdict

SmartPayroll is a great fit for lots of small to medium businesses, particularly if your staff work regular hours and you don’t need integrated timesheet software.

If you and your team are mobile, e.g. tradespeople or cleaners, and you want to rely more heavily on mobile apps, PaySauce might be a better fit. If you’re an agri customer, we have the software and experience to make payday a breeze on farm.

Making the leap from SmartPayroll to PaySauce

For all new customers, we handle set up free of charge.

Our lovely support team will import your full SmartPayroll history and pay details into PaySauce, ready to kick off for your first payday. We’ll run a full training and even sit on the phone with you as you run your first pay to make sure it all goes smoothly. 0800 support is free and available whenever you need a hand.

Thank you for reading!

Any questions, feel free to give our friendly support team a call on 0800 746 700.