Xero for farming

.svg)

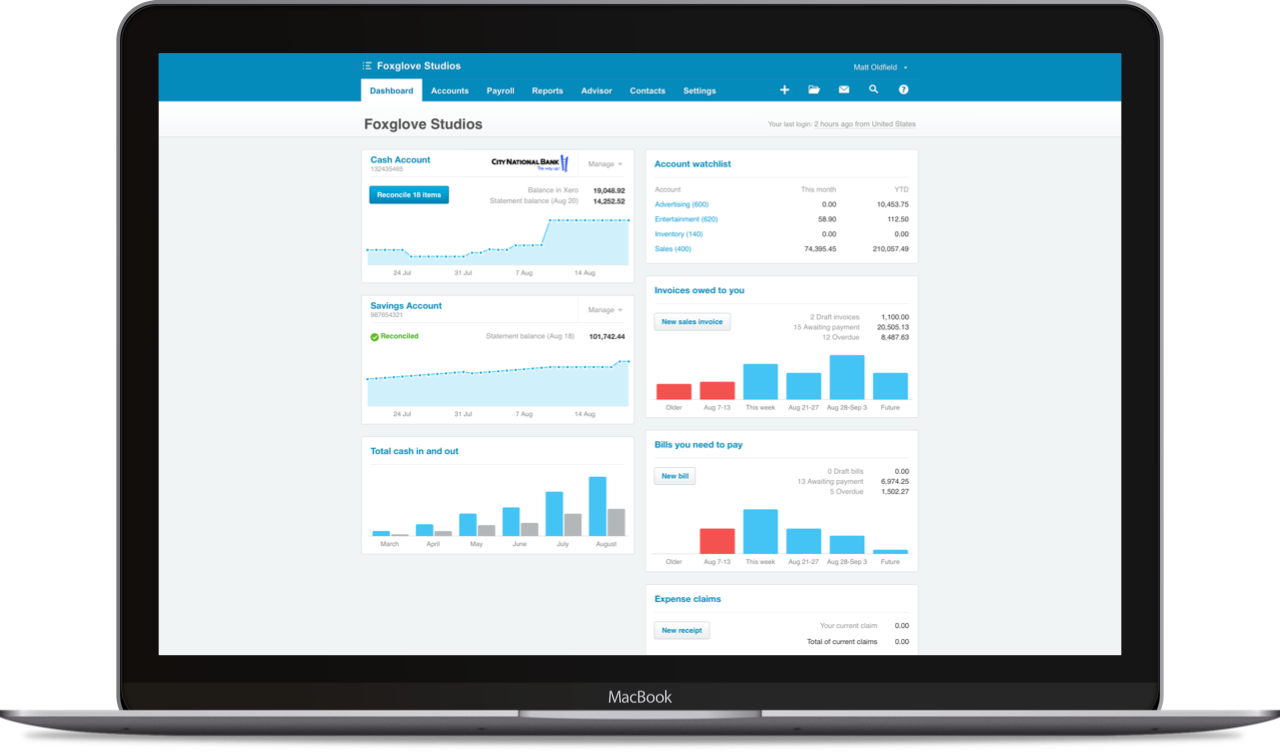

Great farms are run by great teams with the best tools. Find out how the combined power of Xero, Figured and PaySauce can help your farming clients run a more informed and efficient business.

Running a better farming business with Xero, Figured and PaySauce

Farming is an ever-changing industry. Demands on farmers to feed a growing global population continue to rise and the complexity of modern farming means farmers need to be experts in a broad range of areas – both on the farm and in the office.

Great farms are run by great teams and the best farmers surround themselves with experts and make use of technology to lighten the workload. That’s why Xero, Figured and PaySauce have come together to form the definitive agricultural financial management technology stack for farmers and their team of experts.

Value for farmers

Give clients an up-to-date view of their whole business and a clear strategy for the future. Together Xero, Figured and PaySauce take care of financial and HR compliance requirements giving your clients peace of mind and mitigating costly mistakes.

Budgeting and financial forecasting is made easy and the whole farming governance team will have access to the information needed to make decisions with clarity and confidence.

With compliance and governance taken care of, clients will be in the best position possible to access bank capital by illustrating a mitigated risk profile.

Value for advisers

Enhance your position as a valued contributor to a financially sustainable farming operation and become the agri adviser of choice in your community.

Using Xero, Figured and PaySauce, you can help your clients embrace being ‘bank ready’ by solving regulatory financial compliance, people compliance, and budgeting and forecasting needs.

With this partnership, you can offer clients relevant, accurate and timely advice in a scalable and repeatable way. Empower your clients to be in the best possible position to access bank capital with the confidence to act quickly.

Interested in getting the best tools for your farm?

and mention ‘Xero for Farming’ or talk to your financial adviser!

Strengthen relationships with the help of these resources

We’ve created some handy resources to help you work with your clients, strengthen your relationship, and demonstrate the power of Xero, Figured and PaySauce for their farming business.

Webinar

Tailored slides to show your clients how Xero for farming works

Facebook and LinkedIn tiles

Share imagery and messages with your clients on social media

Email templates

Invite your clients to explore Xero, Figured and PaySauce with you

Xero for farming video

Show your clients how Xero, Figured and PaySauce work together

Partnership guide

Find out how you can help your clients work more efficiently with Xero, Figured and PaySauce

Brochure

Introduce your clients to how Xero, Figured and PaySauce work together

From seeing the detail to big picture thinking

Col & Di Wilson

From city life to farm life

Col Wilson met his wife Di when he bought some drench from the local vet clinic and won a trip to Sydney where Di was living at the time.

After a whirlwind romance and a year of long distance phone calls, Kiwi-born Di made the move back across the ditch.

“My friends laughed when I said I was moving to Whakatane to live with ‘Colin the cow farmer’,” says Di. “I thought I knew what I was up against but it wasn’t until I started living the life that I realised how intense it was.”

Col, on the other hand, was brought up on a dairy farm, left school at 16 and got straight into it. But while he knew everything there was to know about farming, his business skills weren’t up to scratch.

“I really needed somebody like Di,” says Col. “I’m terrible at admin. I just scribble on bits of paper and have piles of it everywhere.”

Three farms, a baby, and a business plan

Using the combination of Col's background in dairy farming and Di’s business skills, they entered and won the Bay of Plenty Sharemilker of the Year award in 2000.

“After that I became more and more involved with the business,” says Di. “And the administration side of things just got bigger and bigger.”

“She’s putting it mildly,” says Col. “Di was very busy in the office. We were running a big sharemilking job and two of our own dairy farms, we’d just had a baby and I was gallivanting around the countryside.”

They both knew they wouldn’t be able to sustain this lifestyle long term, so they made a ten year business plan – to exit sharemilking, run their own business and reduce Di’s workload. They achieved it all in five years.

“Our accountant was always looking for ways for me to spend less time in the office and make the job easier and quicker,” says Di. “That’s where the programs we use made a difference.”

I like the fact that with Xero I can ring up Katie, I can have Xero in front of me and so does she and we’re looking at the same thing. There’s no confusion.Di Wilson, Wilson dairy farming

Running the business with Xero and Figured

Col and Di were introduced to Xero and Figured three years ago by their accountants, Brett Bennett and Katie Priebe at FARMit. And streamlining their processes has made things a lot easier for Di in managing the business.

“Prior to Xero, I would code things for our business and at the end of the year our accountant effectively had to redo the whole thing,” says Di. “I like the fact that with Xero I can ring up Katie, I can have Xero in front of me and so does she and we’re looking at the same thing. There’s no confusion.”

As well as using Xero with FARMit, Di has also looped in farm management software, Figured to ensure everything is connected.

“Using Xero and Figured together means we’re not double handling,” says Di. “They interact so you don’t have to keep giving the same figures over and over again. And there’s less room for error because it’s going from one program into the other without any human contact to muck it up.”

Being able to consolidate her hours with Xero means that Di can see the detail she needs to ensure the business is running smoothly, and has enabled her to take a part-time job in town.

“I love the flexibility of having our own business and being able to work outside of the business doing something completely different and at the same time still have a handle on what’s going on.” says Di.

Fostering new talent

The long term plan for Col and Di was always to move off the farm, buy their own lifestyle block, take a step back from the day-to-day running of the business and support local talent.

So now in his broader management role, Col has taken on contract milkers at both of their farms, with the farm in Waiohau being run by Hare Ngaheu, winner of the Ahuwhenua Young Māori Farmer of the Year in 2018.

“Hare started working for me through an agricultural work scheme. He had a great attitude, a great smile and a great ethic for work,” says Col. “We want to see people grow. I was young and enthusiastic once, I used to love driving farms, but it’s somebody else’s turn now.”

Knowing that their farms are in capable hands has given Col and Di the space to start making plans for their future. And with help from Xero, Figured and the team from FARMit they’ve got their business into a position where they can run it from anywhere.

“Our five year plan is that we’d like to do a lot more travelling initially around New Zealand,” says Di. “Xero’s helping us plan financially for that and it will mean we can continue to run our business and monitor it no matter where we are.”

We want to see people grow. I was young and enthusiastic once, I used to love driving farms, but it’s somebody else’s turn now.Col Wilson, dairy farming

Using technology to transform a farming business

How a growing poultry and dairy farmer used Xero, Figured and PaySauce to transform his business and make financially-informed decisions.

Ed Whiting isn’t one to shy away from technology. In fact, running three farms means technology is crucial to keep them all going. The chicken sheds on his poultry farm are computer controlled, so food and water levels can be checked instantly, and shed temperatures and humidity can be automatically set and monitored.

As the owner of Airport Farm, Ed is acutely aware of how technical innovation can help with the success of his business. Using the latest technology, he’s made work more efficient and has had substantial success in calf rates and reduced his animal health costs.

But when it came to managing his finances, Ed wasn’t making the best use of Xero – his cloud-based accounting software – and Figured – his farm management system.

He was tracking his development expenditure and progress using spreadsheets, which not only took up a lot of his time but also opened the business up to potential data inaccuracies and even profit loss.

With multiple revenue streams to manage and a huge capital development project, Ed became overwhelmed with the amount of information coming in. So, he hired an administrator to keep things on track.

Using Xero to process their day-to-day transactions and generate GST returns made life easier, but they still weren’t using Xero to its full capacity – and they were barely using Figured at all.

Getting up to date with Xero and Figured

Working with Amanda Burling, his accountant at Baker Tilly Staples Rodway in Taranaki, Ed was shown what his business could achieve by using the true functionality of both Xero and Figured together.

“Seeing Ed’s reaction when we explained it all was priceless,” says Amanda. “All of his issues would be solved without the need to have a spreadsheet tracking everything in the background.”

Figured has been specifically designed to meet the needs of the agricultural industry. And with multi-farm functionality, Ed can either budget per farm or on a consolidated basis, and the software includes production tracking, real-time budgeting and planning, as well as various reporting options.

Once he had been set up correctly on both Figured and Xero, Ed and Amanda were able to get accurate real-time information that meant they could easily access and identify how his capital development project was tracking.

And Amanda was able to see that Ed was going to be short on funding to complete the project. With an updated forecast and access to actual spend-to-date reports, Ed and Amanda were able to clearly see overspends, under budgeting, and what the shortfall was going to be.

“With all this information available, it meant that obtaining additional funding was relatively straightforward,” says Amanda.

Using the ‘Scenario’ tool in Figured meant Ed and Amanda were able to show the bank what the future looked like, give a clear indication of when debt repayment would occur, and show the business would still be in a healthy financial position at the end of it.

“Now that we have Figured running well, I spend more time looking at where we are and where we’re going. This means I can make financially-informed business decisions faster, saving time and headspace,” says Ed. “There are hours and hours of unproductive thought wasted on not knowing your financial position, it kills productivity and the ability to work efficiently.”

Introducing PaySauce for payroll

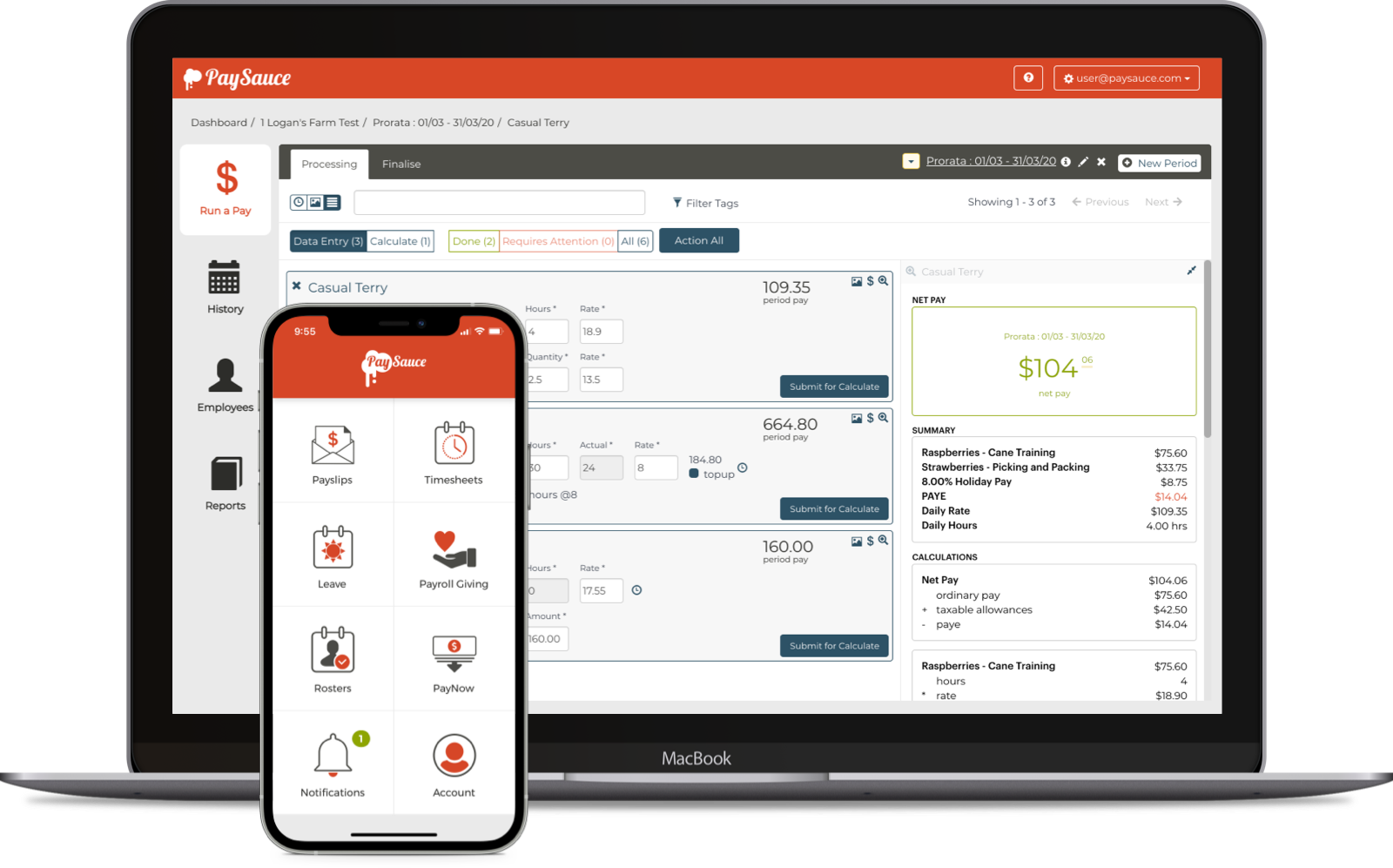

With more than 20 employees, getting an efficient and straightforward payroll solution was important for the smooth running of the business. So Amanda introduced Ed to PaySauce.

Using PaySauce meant Ed’s employees could enter their time via a mobile app, select which farm they were working on and – if they were working in construction – even enter the exact shed they were working in.

For Ed, it means he and his accountant can see the accuracy in variance reporting per farm. They can also keep track and separate construction wages from operational wages.

Running all his farms through his Xero account and using Figured means that Ed and Amanda can see the profitability of each farm. They can also track expenses per farm and per chicken shed, which makes shed performance analysis and asset capitalisation much more efficient.

Having easy access to this information means Ed is empowered to make informed decisions about where his business is heading.

The ability to plan and react to data in such a volatile economic landscape is crucial to business success. And using cloud-based systems also means that Ed, his accountants and bank manager can remotely collaborate around the same data.

“It also means that our time involved in completing the annual financial statements is a lot less,” says Amanda. “And that allows us to concentrate on providing value to the future of Ed’s business.”

Get a clearer picture of your farm with Xero for farming

Hi [client name],

We’re excited to be working with the team at Xero, Figured and PaySauce to help you better plan and manage the finances of your farm.

Discover a better way to manage your farm finances

Together Xero, Figured and PaySauce take care of all your accounting, compliance and regulatory needs and offer a complete solution for staying on top of today’s finances as well as planning for the future.

How Xero, Figured and PaySauce can help you:

-

Team effort - planning with confidence Great farms take great teams. A sound governance structure needs quality data to make well informed and confident decisions and be well positioned to react to market volatility. You, your farming team and I can input data into the same place. So, there’s less time spent on data entry and collating multiple spreadsheets.

-

Stress-free payday Ditch the paperwork and confusing calculations with an accurate and efficient payroll system. Digital timesheets, minimum wage top-ups, automated payments and Inland Revenue filing.

-

Save time, access capital and get paid faster With sound systems and governance, you’ll be well positioned to not only ride the waves of market volatility, but access capital by being ‘bank ready’.

-

Simple, easy-to-use software Working online means you don’t have to download information and email it to us. It’s an easier and more efficient way to work – with a user-friendly and intuitive experience.

Get in touch to find out about how Xero, Figured and PaySauce can improve how we manage your farm’s needs and accounts.

Best regards,

[accountant name]

Free webinar: plan for the future with Xero, Figured and PaySauce

Hi [insert first name],

We’re always looking for ways we can help you run your farm more efficiently. We want to make sure that you’ve got access to everything you need to run a better farming business.

That’s why we’ve teamed up with Xero, Figured and PaySauce - a combination of tools and technology designed to help you plan for the future of your farm.

Join us for a free webinar at [time] on [date] to find out everything you need to know about Xero for farming and how this partnership can help you satisfy compliance and regulatory requirements.

We’ll explore how you can gain better control over your farming finances and get a step closer to achieving your long-term business and personal goals.

You’ll get an insight into how to improve your chances of securing future lending from banks and how the top farmers are working with their rural managers and accountants to form a successful governance structure.

Register for the webinar on [date] and find out how Xero, Figured and PaySauce work together to help you run a better farming business.

[insert RSVP details here]

Best regards,

[accountant name]

Reminder: free webinar to learn more about Xero, Figured and PaySauce

Hi [insert first name],

Don’t miss our free webinar to find out how we can help you plan for the future of your farm.

We want to make sure that you’ve got access to everything you need to run a better farming business – so in our webinar we’ll introduce you to the ultimate combination of tools and technology – with Xero, Figured and PaySauce.

Join our free webinar at [time] on [date] to find out how this partnership can help satisfy compliance and regulatory requirements.

We’ll take a look at how you can have better control over your farming finances, and get a step closer to achieving your long-term business and personal goals.

You’ll get an insight into how to improve your chances of securing future lending from banks and how the top farmers are working with their rural managers and accountants to form a successful governance structure.

Register for the webinar on [DATE] and find out how Xero, Figured and PaySauce work together to help you run a better farming business.

[insert RSVP details here]

Best regards,

[accountant name]

Helping clients plan for the future with Xero, Figured and PaySauce

Hi [insert first name],

If there was ever a time to ensure that a client’s financial position is secure, it’s now. That’s why we’re working with our farming clients to prepare them as best as we can for the year ahead.

Our goal is to ensure that our agri clients have a robust financial plan in place before the end of this financial year. And our relationship with you is a vital part of ensuring that our clients maintain a healthy cash flow at all times.

To help with this, we’ve teamed up with Xero, Figured and PaySauce with a plan to have next year’s budget created before the beginning of a new production season.

We’d love to take you through how the Xero, Figured and PaySauce partnership works at a webinar we’re hosting this month. It will be the first step in building stronger relationships to best serve our clients to be compliant, ‘bank ready’ and help them take ownership of their numbers.

Register for the webinar today or get in touch if you have any questions.

[add links to webinar and dates]

Best regards,

[accountant name]

Thanks for joining our Xero, Figured and PaySauce webinar

Hi [insert first name],

Thanks for coming along to our webinar this week. We hope you enjoyed the session!

We’ll be in touch shortly to talk through the Xero, Figured and PaySauce partnership and how it can work for you. We want to ensure that your business is in the best possible position to reach your personal and professional goals.

In the meantime, please get in touch if you have any questions or if you’d like any further information.

Thanks again for joining us online, Kind regards,

[accountant name]